Business Growth Benchmarks

Your life as an entrepreneur will be so much easier if you know the right growth pattern for your business.

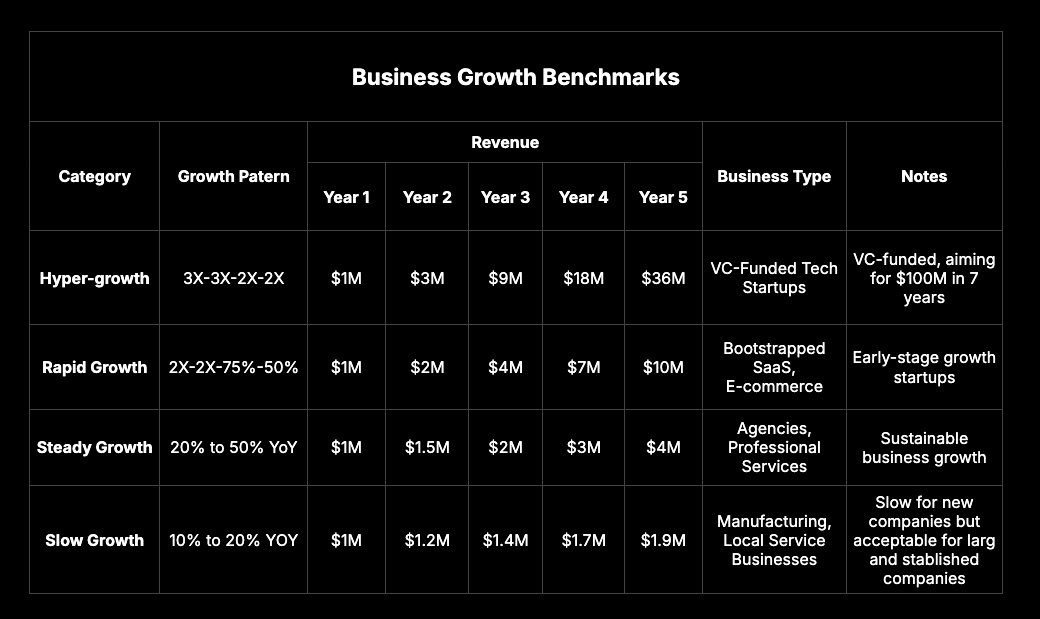

Assuming your business does $1M in revenue in year 1, here are the growth benchmarks for different types of businesses.

If you want to learn more after reading this table, keep going.

Here are four different types of growth for all businesses, no matter what market they’re in or what the business model is:

1. Hypergrowth

These are usually VC-backed companies with a very, very large market. The revenue growth pattern for these companies is typically 3X-3X-2X-2X. This means that if a company starts with $1M in year 1, the goal is to triple that in year 2 ($3M), then triple again in year 3 ($9M), then double in year 4 ($18M), and double again in year 5 ($36M).

The goal here is to reach $100M in revenue within about seven years.

But here are two things you need to know about this type of growth:

- This is very rare, like Uber-level rare.

- You need a massive market.

- It’s highly unlikely to happen outside of Silicon Valley.

So if your goal is hypergrowth and you’re outside of Silicon Valley, know that this is not a good goal. Instead, make your goal to get to Silicon Valley first, and then aim for hypergrowth. There, you’ll be surrounded by people who have played this game many times before.

2. Rapid Growth

These are usually companies with a great product and a large market, but they aren’t necessarily VC-backed. The growth pattern here is 2X-2X-75%-50%.

So, if you do $1M in revenue in year 1, you have the potential to reach $15M by year 5.

This means you’re not building a $100M company in five to seven years, but you’re still growing fast. Bootstrapped SaaS and e-commerce businesses often fall into this category.

3. Steady Growth

This growth pattern is typically 20% to 50% year-over-year. These businesses aren’t scaling rapidly, mostly because they’re targeting smaller markets, but they’re still growing at a healthy rate.

Businesses like agencies or professional services fall into this category.

4. Slow Growth

The growth pattern here is 10% to 20% year-over-year.

If you’re growing at this rate, you better be a big, established company like Boeing or Coca-Cola, otherwise, you’re growing slower than most businesses.

This type of growth is common in capital-intensive businesses like construction companies, auto repair shops, or farming.

That said, if you have a strong operations system and a great team, there’s potential to move up to Steady Growth or even Rapid Growth.

A Note on First-Time Founders

Not every business can hit $1M in year 1 and that’s totally fine.

If you’re a first-time founder (like me), understand that you will make a ton of mistakes and have a lot to learn. The key is to not give up, learn from those mistakes, and keep playing the game.

So if you’ve just started and you’re still figuring things out, it’s normal for it to take a few years to reach $1M in revenue.

If your growth pattern is rapid (2X-2X-75%-50%), but you’re starting with a smaller number in year 1, your revenue will be below $1M for the first few years.

For example, if you make $50K in year 1, and follow the rapid growth pattern, your numbers would look like this:

- Year 2: $150K

- Year 3: $300K

- Year 4: $500K

- Year 5: $750K

By the end of year 5, assuming you didn’t quit, you will have learned so much about running and growing a business.

At this point, you’ll have two options:

1. Continue Rapid Growth

You could go for another five years of rapid growth (2X-2X-75%-50%), which would get you to:

- Year 6: $1.5M

- Year 7: $3M

- Year 8: $5M

- Year 9: $7M

- Year 10: $10M

Not bad, right?

2. Sell & Start Over

Or, you could sell the business and start a new one.

This time, since you’re starting with experience, there’s a high chance you’ll hit $1M in year 1 and then grow rapidly (2X-2X-75%-50%) from there.

If you take this route, you could reach $10M in revenue by the end of year 5 of your new business which would be your 10th year as an entrepreneur.

So with both options you can get to the $10M in revenue mark by the end of year 10 but with the sell and start over option you may receive some cash from selling the first business. Of course, this depends on how well run that business was and if there was good profit.

With both options, you can reach the $10M revenue mark by the end of year 10. But with the sell-and-start-over option, you might also get some cash from selling your first business. Of course, that depends on how well the business was run and whether it was profitable.

The Key Takeaway

As you can see, there are different business growth patterns.

Your life as an entrepreneur will be so much easier if you know the right growth pattern for your business. This way, you know who to compare yourself to.

It’s kind of like soccer formations. In soccer, you have common formations like 4-4-2 or 4-3-3. The manager picks the right formation based on the players they have and the opponent they’re facing.

Business works the same way.

You need to understand the common growth patterns (or formations) and then pick the one that fits your business based on the resources you have and the market you’re playing in

I learned this from Ryan Deiss of The Scalable Company.

Discussion